Welcome to our Blog

Poverty-beating, planet-protecting stories to inspire you.

Blogs

Welcome to our blog! Here you'll find stories of the work we're doing together to fight inequality and end poverty and injustice.

Policy Hub

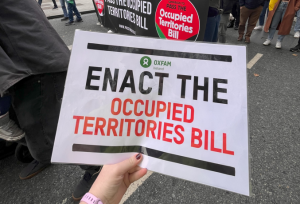

Find out more about our influencing work to tackle the root causes of poverty.

News & Stories

Learn more about how Oxfam Ireland is fighting inequality to end poverty and injustice