- 4 min read

- Published: 13th January 2023

Ireland’s two richest people have more wealth – €15 billion

– than half of the Irish population who have €10.3 billion.

Today (Jan 16th) Oxfam publishes a report that shows for the first time in a quarter of a century the rich are getting richer while the poor are getting even poorer. Staggering inequalities are highlighted in “Survival of the Richest”, as elites gather in Davos, Switzerland for the World Economic Forum.

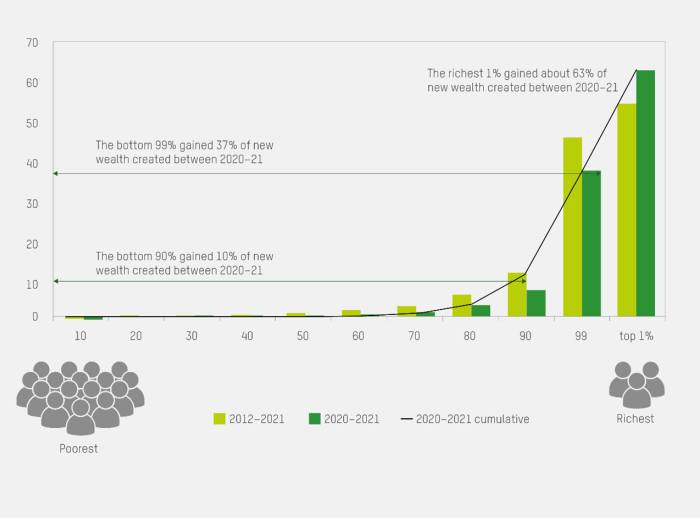

Alarmingly, the report captures the acceleration in inequitable wealth distribution. Globally, over the past two years, the richest 1% have acquired nearly twice as much wealth as the rest of humanity — the 99% put together. This comes on top of a decade of unprecedented gains for the super-rich. (See Figure 1 in notes.)

In Ireland:

- The number of Irish people with individual wealth of over €46.6 million (US$50 million) has more than doubled between 2012 and 2022, rising from 655 to 1,435 people.

- For every €93.15 (US$100) of wealth created in the last ten years, €31.67 (US$34) has gone to the richest 1% and less than €0.5 to the bottom 50%. This means that the richest 1% have gained 70 times more wealth than the bottom 50% in the last 10 years.

- The richest 1% of Irish people have 27% of wealth and the bottom own just 1.1%

Oxfam Ireland’s CEO, Jim Clarken, said: “This rising wealth at the top and rising poverty for the rest are two sides of the same coin, proof that our economic system is functioning exactly how the rich and powerful designed it to.

“It was 10 years ago when we first sounded the alarm about extreme inequality at the World Economic Forum and yet since then the world’s billionaires have almost doubled their wealth. As crisis after crisis hits the poorest people hardest, it’s time for Governments, including Ireland’s, to tax the rich. The very existence of billionaires while out-of-control inequality rises, is damning proof of policy failure.”

A wealth tax on elite Irish wealth at graduated rates of 2%, 3% and 5% above a high threshold of €4.7 million would raise €8.2 billion annually, with the potential to transform Irish public services in health, housing and education while also delivering on our international and climate commitments.

Internationally the money is even more urgently needed by ordinary people. Entire countries are facing bankruptcy, with the poorest countries now spending four times more repaying debts to rich creditors than on healthcare. Three-quarters of the world’s governments are planning austerity-driven public sector spending cuts — including on healthcare and education — of $7.8 trillion over the next five years.

Jeff Bezos, one of the world’s richest men, paid a ‘true tax rate’ of just 1% from 2014 to 2018. Aber Christine, a market trader in Northern Uganda who sells rice, flour and soya, makes $80 a month in profit. She pays a tax rate of 40%.

Where this has led is to the World Bank announcing that the world has almost certainly lost its goal of ending extreme poverty by 2030. “Global progress in reducing extreme poverty has grinded to a halt” amid what the Bank says was likely to be the largest increase in global inequality and the largest setback in global poverty since WW2. The World Bank defines extreme poverty as living on less than $2.15 (€2.30) per day.

Oxfam believes an international approach to taxing the super-rich is needed and we are calling for governments to introduce both permanent wealth taxes and temporary windfall taxes.

We want an end to crisis profiteering. Research shows that this is responsible for between 50%-80% of cost-of-living increases in the US and Europe.

We are calling for a tax on the wealth of the richest 1% percent at rates high enough to redistribute these resources. Oxfam believes that, as a starting point, the world should aim to halve the wealth and number of billionaires between now and 2030 and ultimately abolish this extreme inequality.

At home, Oxfam Ireland is specifically calling on the Irish Government to apply a wealth tax on elite Irish wealth at graduated rates of 2%, 3% and 5% above a high threshold of €4.7 million. This would raise €8.2 billion annually.

ENDS

Full report available here. Methodology available on request.

Contact: Clare Cronin, External Communication Manager: +353871952551

Notes to the Editor:

Wealth calculations

Oxfam’s calculations on wealth and inequality are based on the most up-to-date and comprehensive data sources available.

By combining data from Forbes, Credit Suisse and Wealth-X, a private company producing wealth data for market analysis, Oxfam has been able to assess wealth and inequality per country in much greater detail, to the top 1% and 5% and to count numbers of high-net worth individuals.

In Ireland Oxfam Found:

- 8 billionaries

- 1,435 individuals with €47 million

- 20,575 individuals worth over €4.7 million.

While Ireland’s number of billionaires has dropped from nine to eight, the numbers of individuals in each of the other two categories above has more than doubled in the last decade, by 119% and 118%. All of these figures are adjusted for inflation.

By using Credit Suisse’s Global Wealth Reports and data, Oxfam has found:

- The top 1% of Irish society owns 27% of wealth - (€232 billion)

- The top 10% owns 64% of wealth (€547 billion).

- The bottom 50% of Irish society owns only 1% of wealth (€9 billion).