Tax the Super Rich

Billionaire wealth is skyrocketing, while one in four are going to bed hungry each night. But it doesn't have to be this way, together we can fight for a more equal world where the rich pay their fair share. It isn’t rocket science – let’s tax the super rich.

Sign up to join the fight against inequality

You’ll get campaign updates, and stay informed about events, webinars and ways to take action

Why does Ireland need a wealth tax on the super-rich?

We answer your common question around this wealth tax.

Resisting the Rule of the Rich report

Oxfam's 2026 report, released to coincide with the World Economic Forum in Davos.

This is what a global inequality crisis looks like:

- Globally, the 12 richest billionaires own more wealth than the poorest half of humanity – over four billion people.

- Ireland's billionaires are richer than 66% of the population or equal to about 85 per cent of the adults in the State.

- In the space of just a single working day, the average Irish billionaire will make the equivalent of an average person’s entire annual income.

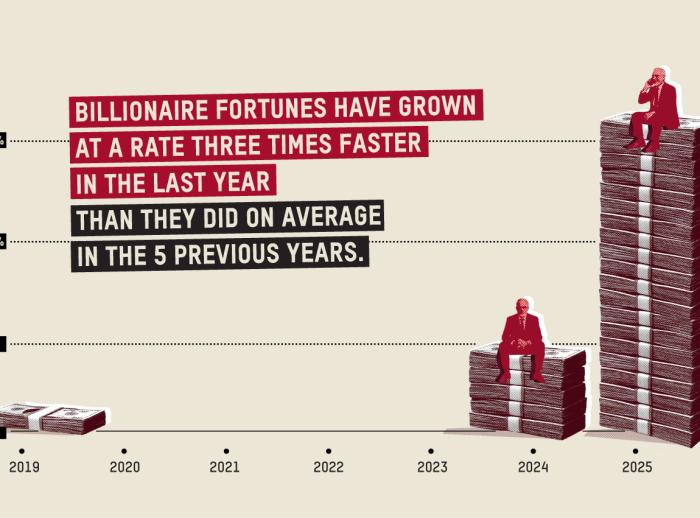

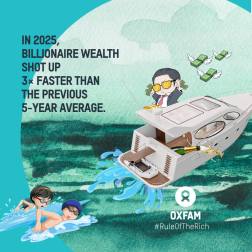

- Billionaire wealth grew three times faster in 2025 than the average annual rate of the previous five years, reaching a record €15.5 trillion.

- There are now over 3,000 billionaires worldwide, while one in four people globally face hunger.

- In the space of just a single working day, the average Irish billionaire will make the equivalent of an average person’s entire annual income.

- Billionaire wealth grew three times faster in 2025 than the average annual rate of the previous five years, reaching a record €15.5 trillion.

- There are now over 3,000 billionaires worldwide, while one in four people globally face hunger.

These are all symptoms of an unequal economic system. One that prioritises the wealth of a few and sees billionaires and big business profiting more than ever. While most people, especially those living in poverty, pay the price.

Does this inequality affect the climate crisis?

Yes. The richest 1% are responsible for as much pollution as two-thirds of the world combined. They have the resources to shield themselves from the worst of it, while the poorest – who’ve done the least damage – are getting the worst of it: floods, droughts, rising seas.

Why does Oxfam work to tackle inequality?

Oxfam works to tackle inequality because inequality makes poverty worse. Inequality undermines the fight against poverty around the world.

We’ve been seeing this for decades through our work in communities and in our research. What we are living through today is more than a cost-of-living crisis, it’s an inequality crisis and it’s deepening poverty the world-over.

Inequality is not inevitable

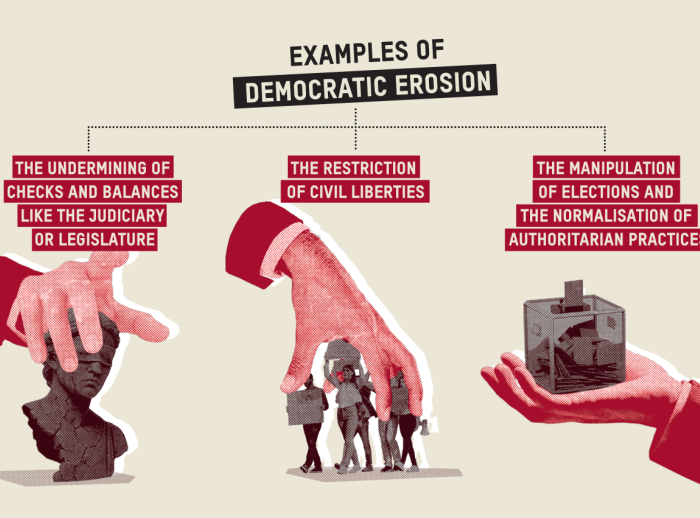

Governments can make choices that prevent inequality. They can make choices that mean people can live safe from hardship. Instead, governments worldwide are making choices designed to protect the power and wealth of a privileged few, while removing the power of everyday people.

Let’s reclaim our collective power and hold decision makers to account. Let's push governments to make better choices. So that those who profit the most, who can afford it the most, foot the bill for a fairer and more equal world. One that benefits everyone.

How can it be fixed?

Inequality isn’t going to be solved overnight. At Oxfam, we think that taxing the super-rich is the start of ending this shocking spiral – stopping the super-rich from getting richer and helping to consolidate their power.

In January 2026 Oxfam Ireland published landmark research that shows billions could be raised from taxing the very rich in Ireland.

tax on net wealth of the top 1% could yield €1 billion

would raise around €2.5 billion

“We know that extremism thrives on inequality. A wealth tax could help cohesion. The public services it would fund would go some way to tackling the cost-of-living crisis and the housing emergency”— Jim Clarken, Oxfam Ireland CEO

We don’t have to accept a system that puts billionaire wealth over people and the planet. There’s a better way, one that values fairness, sustainability, and equality.

Ireland can take a bold step and follow the example of countries like Spain, Norway and Switzerland by introducing a wealth tax on the super-rich.

Why does Ireland need a wealth tax on the super-rich?

What can I do to fight inequality?

We need to make it clear to those in power: enough is enough. We won’t accept this any longer. Governments and institutions have the power to change things, and it should start with one simple step – make the super-rich pay their fair share.

A fairer world is within reach if we come together and demand a system that values everyone, no matter who we are.

I only have a minute:

Join us in the fight

Sign up to get updates on our campaign, including events, webinars and ways you can take action

I have 5 minutes:

Why does Ireland need a wealth tax on the super-rich?

Join Us On Social

On Instagram, TikTok, Facebook, and Bluesky. Engage with our campaign video on social media.

I have more time:

Oxfam’s Equals Podcast

Listen to get deeper into the issue of wealth inequality. Available on Substack, Apple Podcasts, and Spotify.

Resisting the Rule of the Rich report

Oxfam's 2026 report, released to coincide with the World Economic Forum in Davos.

Confronting Wealth Inequality in Ireland Report

Written by Dr Tom McDonnell, and Ciarán Nugent of the Nevin Economic Research Institute and Sorley McCaughey, Public Affairs consultant.

Take Action

Write to your local TDs in your own words to let them know you want to Tax the Super Rich.