- 5 min read

- Published: 3rd April 2016

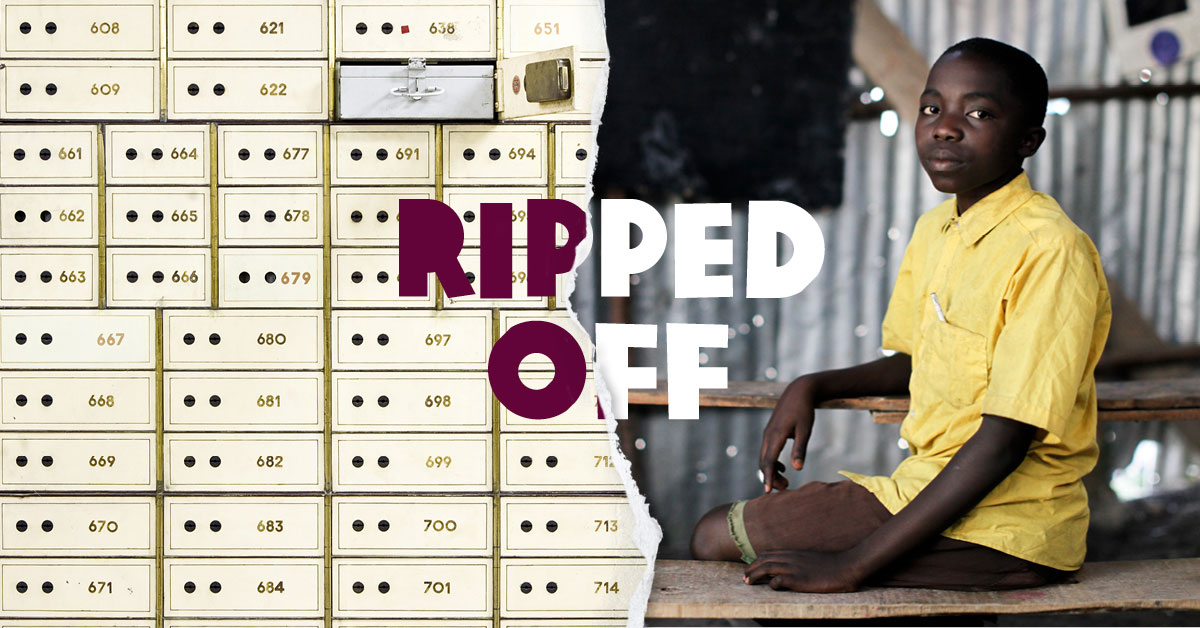

Panama Papers and the human cost of tax dodging

Imagine sharing your home with a housemate who raids your section of the fridge, frequently ‘borrows’ your things without telling you and doesn’t make any effort to clean or maintain the shared living space. A housemate who can well afford to pay their way – but doesn’t contribute their fair share towards the bills.

That’s how putting up with tax dodgers feels. It leaves the vast majority of people, i.e. ordinary tax-payers, making up the shortfall left by those who can most afford to pay it but don’t. Tax dodging also hurts the most vulnerable in society who can’t access quality public services as a result.

As details emerge from the Panama Papers exposé by the International Consortium of Investigative Journalists, a spotlight has been shone on tax dodging by wealthy individuals the world over.

BREAKING: The #PanamaPapers - Politicians, Criminals and the Rogue Industry That Hides Their Cash https://t.co/LDcslHoLAb

— ICIJ (@ICIJorg) April 3, 2016

It’s the latest major investigation into tax dodging by the worldwide organisation of reporters following LuxLeaks in 2014 and Swissleaks last year.

Panama Papers is a rare glimpse into a toxic global tax system where wealthy individuals, who in a progressive tax system should be paying the most in tax, have the biggest incentives to exploit this weak architecture to avoid paying their fair share.

Their names are in the news. But the names of those most harmed by tax dodging are not. As long as tax dodging continues to drain government coffers the world over, there is a human cost with less to spend on vital public services and the resources needed to tackle poverty, put children in school and prevent citizens dying from lack of healthcare.

Every single year, poor countries lose approx. €150 billion/£119 billion due to tax dodging by wealthy individuals and companies.

Outside a hospital in Malawi, parents and their babies sit on the ground in the long queues.

Public health facilities in Malawi are free at the point of use, meaning they are not as regressive as is the case in many countries in Africa where fees are charged (making them out of reach for the poorest). But persistent shortages of medicines and staff mean that these facilities often provide a very poor quality service, despite the best efforts of their few heroic health workers.

“As a nurse, I love my job and I love helping people,” says Vitumbiko Mhango who works at the Kamuzu Central Hospital and Bwaila maternity clinic.

Inequality in Malawi

“A shortage of staff is really impacting on our delivery of services. Patients have to wait very long for many hours just to be attended to. It makes me feel sad because as a nurse I feel I’m failing my job.”

Malawi has experienced rapid economic growth in recent years, but the gains of this growth have not been spread evenly and the gap between rich and poor has widened at an alarming pace. Today, half of all Malawians live in poverty.

We have calculated that the lost tax revenue from the money revealed to be held by Malawians in HSBC accounts in Geneva – as revealed by the International Consortium of Investigative Journalists in their SwissLeaks exposé in 2015 – could pay the salaries of 800 nurses for one year.

When taxes go unpaid due to widespread avoidance by wealthy individuals and companies, government budgets feel the pinch – the coffers are drained when it comes to investing in healthcare, schools and infrastructure. But universal and affordable public services are vital to lifting people out of poverty and it is the poorest, unable to afford ‘to go private’ who suffer the most when they are not provided by the state.

There is no getting away from the fact that the big winners in our global economy are those at the top and the gap between them and the rest of society is widening. Earlier this year, our research showed that just 62 billionaires own the same wealth as the poorest half of the population – so few they would fit onto a coach from Belfast to Dublin.

This elite group has become more exclusive over the years – falling from 80 members last year and 388 as recently as 2010. Our economic system is heavily skewed in the favour of the wealthiest, and arguably increasingly so. Far from trickling down, income and wealth are instead being sucked upwards at an alarming rate. Once there, ever more elaborate tax dodging and an industry of wealth managers ensure that it stays there, far from the reach of ordinary citizens and their governments.

All governments, rich and poor, must work to end tax dodging because it is their citizens – their electorate – who are the biggest losers. They need to fix the system and penalise banks and any others who facilitate tax dodging.

Ahead of the Irish general election in March, an Oxfam Ireland survey conducted nationwide found that 82% of people agreed that measures to specifically address tax dodging needed to be a priority for the incoming government and Taoiseach. The survey also showed growing concern in relation to large-scale tax dodging with 86% of Irish people believing that big companies and wealthy individuals are using tax loopholes to dodge paying their fair share of taxes.

The global tax system clearly does not serve the citizens of the world and this must change. Real transparency is needed – for example, establishing public registers of the beneficial owners of all companies, foundations and trusts (so governments know who really owns and benefits from them and can tax them accordingly).

We also need to know where companies really make their profits and where they are paying their taxes. This would allow countries to fairly tax multinationals where their profits are. To achieve this, a simple solution is on the table.

Country-by-country reporting, as it is called in tax jargon, would require multinational companies to publish exactly this information. Some countries including Ireland have said they will implement it but this information won’t be made public. This is a crucial flaw – because if the information remains confidential between tax authorities, the public and civil society won’t be able to hold multinationals to account for their tax practices – and developing countries won’t be able to scrutinise the global tax arrangements of multinationals operating in their territory.

As political leaders in Ireland continue to engage in discussions on government formation, the measures Ireland can take to assist in the reform of the global tax system should be part of the agreement of any progressive Programme for Government.

Jim Clarken is CEO of Oxfam Ireland.

(Published 3 April 2016)