- 6 min read

- Published: 4th December 2018

Will 2019 be the year when we see real corporate tax reform?

This month the European Union (EU) put the thorny issue of how to fairly tax the digital economy on the long finger. Attempts to reform digital taxation, like efforts to increase public tax transparency and address profit shifting, have stalled at the EU due to opposition from a small number of countries – including Ireland.

Oxfam International’s Executive Director Winnie Byanyima at the World Economic Forum in Davos earlier this year, where she debated Ireland’s Finance Minister Paschal Donohoe on the need for fundamental reform of the global tax system. Photo: World Economic Forum

This month the European Union (EU) put the thorny issue of how to fairly tax the digital economy on the long finger. Attempts to reform digital taxation, like efforts to increase public tax transparency and address profit shifting, have stalled at the EU due to opposition from a small number of countries – including Ireland.

The proposed digital services tax was an imperfect solution. Experts and civil society agree that the real solution lies in fundamentally changing our tax system to meet the challenges of a digitalised economy. This is about more than just a handful of big tech firms dominating the market. Technology is fundamentally changing the way that every industry operates and our tax system must adapt to reflect this.

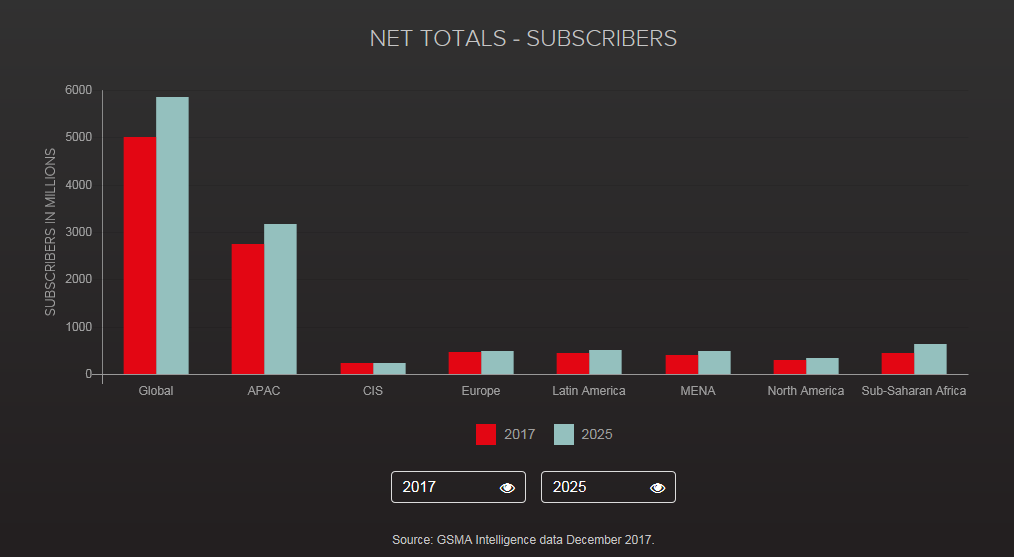

This is worth considering in the context of developing countries in Africa, where Ireland spends most of its overseas development aid. Africa has often been hailed as a technological leapfrogger, particularly in the realm of mobile banking, where Kenya’s M-PESA is leading the way. Sub-Saharan Africa is now a bigger market for mobile phones than North America and it will shortly surpass Europe. Tech companies based in Ireland like Apple are cashing in on this growing market – in 2015, sales of the iPhone grew by 133 percent in the Middle East and Africa. But African tax revenues are not benefitting from this boom because profits from these sales are routed back to Apple in Cork.

The Tax Haven Shuffle

The blacklisting process has produced changes in the way multinationals are operating. Big companies are beginning to move from tropical islands where they pay no tax, to countries where they pay extremely low tax. As reported in Bloomberg, US multinationals are moving their intellectual property (IP) holdings (patents, trademarks, copyrights etc.) from territories like Bermuda and the Cayman Islands to countries like Ireland and Singapore. This trend is known as “onshoring”, or “the tax haven shuffle”, and it happens when zero-tax islands change their tax regimes in response to external trends – in this case following pressure on tax havens from the EU.

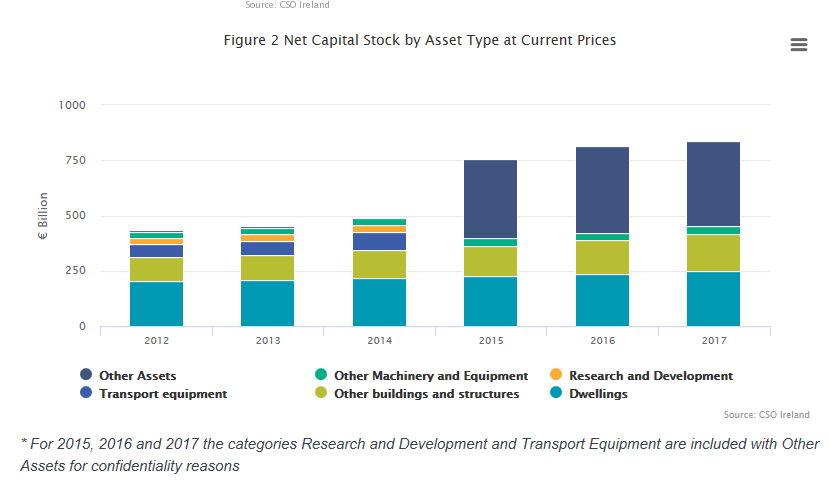

Ireland has incentivised companies to relocate their IP here with reliefs that allow them – in many cases – to reduce their tax liability down to zero percent, replicating what used to happen in Caribbean tax havens. From 1 January 2015 – just after the announcement of the phasing out of the Double Irish arrangement – companies were allowed to offset up to 100 percent of their profits (it was previously capped at 80 percent) against the cost of purchasing IP rights for the relevant period – potentially eliminating any tax bill whatsoever. There has been a sharp uptake in companies availing of this measure, as recognised by the former finance minister Michael Noonan. Deputy Noonan highlighted “a relocation of intellectual property-related assets or patents to Ireland” as a key reason for Ireland’s massive GDP increase of 26% in 2015. Figures released by Irish revenue authorities show that the use of such allowances for intangible assets went up by a massive 989 percent in 2015. The full extent of these transfers were discussed recently in the Irish parliament where it was disclosed that between 2014 and 2017, intellectual property to the value of approximately €300 billion was onshored to Ireland. The law was changed in 2017 so that companies that transfer IP to Ireland after this date will only be able to claim 80 percent relief against profits in any one year.

In his blog, Chair of the Irish Fiscal Advisory Council, Seamus Coffey, estimates that significantly more intellectual property could be transferred to Ireland. Based on the current figure of €70 billion of royalties leaving Ireland annually, he estimates that up to €1 trillion in IP assets could be transferred to Ireland in the next few years. For companies that moved IP here between 2015 and 2017, Ireland may be, in effect, a “no-tax jurisdiction”, with potentially hundreds of billions of euros of reliefs still to be used against future profits. Meanwhile, companies that move IP to Ireland in the future will be able to avail of reliefs that could potentially allow them to have an effective tax rate of as low as 2.5 percent.

Could we see real reform in 2019?

It is true that coordinated efforts at EU, OECD, G20 and UN level are making it more difficult for individual countries to continue to facilitate corporate tax avoidance. In response, countries are more likely to compete for foreign investment by offering ever more generous tax incentives – Ireland’s intellectual property relief being one example – and reductions in their corporate tax rates. This competition is creating a race to the bottom, whereby a small number of countries may temporarily gain in the short term. In the long term, however, every country risks losing out as extreme competitive pressures negatively impact their sovereign right to raise fair levels of tax.

So even if we are successful at reducing – or eliminating – corporate tax avoidance, there is a danger that this race to the bottom will lead to a situation where corporations start reporting the correct amount of profits in each country, but still pay very little taxes on these profits. This has serious implications for poorer countries’ ability to mobilise sufficient domestic revenue to fund universal public services to tackle inequality and beat poverty, and to fund the social and physical infrastructure that fosters prosperity. As women and girls living in poverty are disproportionally impacted by the under-resourcing of public services, this has also implications for efforts to address gender inequality because developing countries need to be able to raise the vital resources necessary for the advancement of women’s civil, social and economic rights.

Efforts to reform the global tax system move to the OECD in 2019, a move which Ireland supports. However, this may be a case of “be careful what you wish for” as it seems that a more fundamental reform of the corporate tax system – including the possible introduction of a minimum effective tax rate – may be on the negotiating table at the OECD next year. In a recent interview, Pascal Saint-Amans, director of the OECD’s Centre for Tax Policy and Administration, indicated that he felt that momentum is building for something big to happen, a kind of BEPS 2.0, which would look at more systematic issues such as the allocation of taxing rights, rather than trying to patch up the existing flawed system, as has happened under the original Base Erosion and Profit Shifting Process (BEPS) process.

The Japanese G20 presidency has also signalled its strong interest in continuing the debate on taxing the digital economy and will hold a tax symposium on the subject in early June 2019 to coincide with the G20 finance ministers’ meeting in Fukuoka. Unlike the original BEPS negotiating agreement, the global south will have some input, albeit limited, into these negotiations through the OECD’s Inclusive Framework. As rising powers like Brazil, India and China have all signalled that more complete reform is necessary, and with the US more open to a global minimum effective tax rate following its recent tax reforms, Ireland’s ability to block reform may be greatly reduced this time around.